The true impact of COVID-19-related shutdowns on the local economy is starting to be felt and can be seen in the sales tax allocations for several southern Burnet County municipalities.

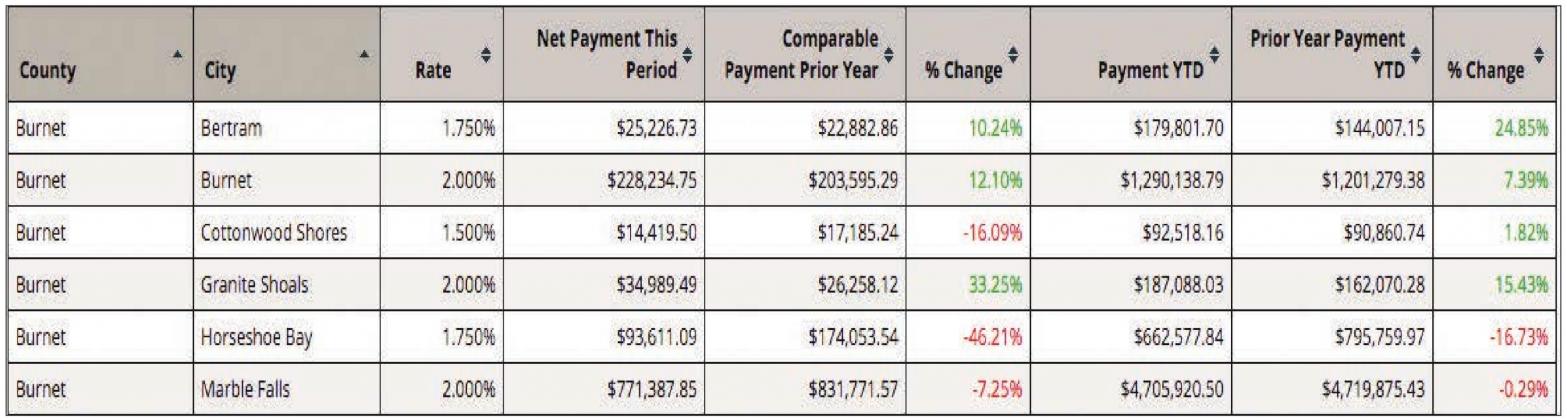

Sales tax allocations for Marble Falls for June dropped by 7.25 percent — more than $60,000 — while Horseshoe Bay reported a decline of more than 46 percent — almost $81,000. Cottonwood Shores had a drop of more than 16 percent — which is about $2,700 for that small community.

The only south-end city to report gains in sales tax revenue was Granite Shoals, which had a jump of 33.25 percent for the month of June — an increase of more than $8,700.

Texas Comptroller Glenn Hegar announced he will send cities, counties, transit systems and special purpose taxing districts $690.4 million in local sales tax allocations for June, 11.7 percent less than in June 2019. These allocations are based on sales made in April by businesses that report tax monthly.

Because ofthe COVID-19 pandemic, widespread social distancing requirements were in place across much of the state in April, leading to the steepest year-over-year decline in allocations since September 2009.

In June 2020, Burnet County municipalities received a combined $1,167,869.41 in sales tax revenues, an decrease of 8.46 percent, or $107,877.21, below the $1,275,746.62 received during June 2019. Overall in Burnet County for the year, sales tax revenues are at $7,118,045.02, up 0.05 percent or $4,192.07 from the $7,113,852.95 received during the same time period last year.

For Marble Falls, city sales tax revenue of $771,387.85 for June was 7.25 percent lower than the $831,771.57 distributed in June 2019. Sales tax receipts make up the lion’s share of general fund revenues for the county’s largest city.

For the year, Marble Falls has collected $4,705,920.50, down 0.29 percent from the $4,719,875.43 collected during the same period last year.

“Frankly, we were pleased to be down only 7.25 percent for April sales activity,” said Christian Fletcher, executive director of the Marble Falls Economic Development Corporation, which receives a half-cent in sales tax for economic development.

“Since that was the first full month of closures related to COVID-19, experts were concerned that we could see a 30-40 percent drop compared to last year. The state as a whole was down 11.1 percent, and almost all of our peer communities were down substantially more than we were: Fredericksburg (-26.17 percent), Bastrop (-14.74 percent), Bee Cave (-22.26 percent), and Brenham (-10.64 percent) are a few examples.”

Fletcher said essential businesses in Marble Falls have withstood the pressures of COVID-19 on the economy, while the mom-and-pop shops on Main Street have reported losses.

“Of course, the impacts are going to be felt differently across various industry sectors,” Fletcher said. “Our top 10 taxpayers (`essential’ businesses) and restaurants with drive-thru services are generally doing very well, while many of our Main Street shops are having a very hard time.

“Because our economy relies so heavily on outside dollars, I think it may be a while before we see sustained and meaningful gains in sales tax revenue like we’ve been accustomed to seeing.”

Fletcher said the EDC is joining forces with the city and Convention & Visitors Bureau (CVB) to sponsor “a Shop Marble Falls campaign to highlight some of the cool things that are happening around town.

“The best thing that we can do to help our really small businesses is to promote shopping in Marble Falls,” Fletcher said.

Sales tax receipts for Horseshoe Bay were down 46.21 percent for June 2020. This month, the city, which straddles the Burnet and Llano county line, received just $93,611.09, compared to the $174,053.54 received in June 2019.

It marks the worst month for HSB sales tax collection in a year of marked decline for the city. For the year, sales tax revenues in HSB are down 16.73 percent, from $795,759.97 in 2019 to $662,577.84 this year. In six months for 2020, the city has received less than it got in the first five months of 2019.

Cottonwood Shores saw a decrease of 16.09 percent in June 2020, down from $17,185.24 to $14,419.50. For the year, sales tax revenues are still up 1.82 percent from $90,860.74 in 2019 to $92,518.16 through the same point this year.

Granite Shoals, on the other hand, saw sales tax revenues rise by 33.25 percent from $26,258.12 in June 2019 to $34,989.49 this June. For the year, sales tax revenues are up a robust 15.43 percent, from $162,070.28 to $187,088.03.

Burnet and Bertram each reported sales tax increases for June 2020, with Burnet up 12.10 percent from $203,595.29 to $228,234.75, and Bertram up 10.24 percent from $22,882.86 to $25,226.73.

Three cities in Burnet County - Marble Falls, Burnet and Granite Shoals - collect the maximum allowable sales tax rate of two percent, while Bertram and Horseshoe Bay collect 1.75 percent and Cottonwood Shores collects 1.5 percent.