City officials approved going forward with acquiring $8 million in sales tax revenue bonds to pay for a number of parks improvement projects that include everything from a new crossing over Backbone Creek to a waterfall feature in Lake Marble Falls.

Marble Falls Economic Development Corporation (EDC) Executive Director Christian Fletcher introduced the recommendation which required approval Oct. 19 from the Marble Falls City Council.

Fletcher explained that money would fund several projects earmarked for the remainder of phase 1b and a portion of phase 1c in the municipalities park improvement plan.

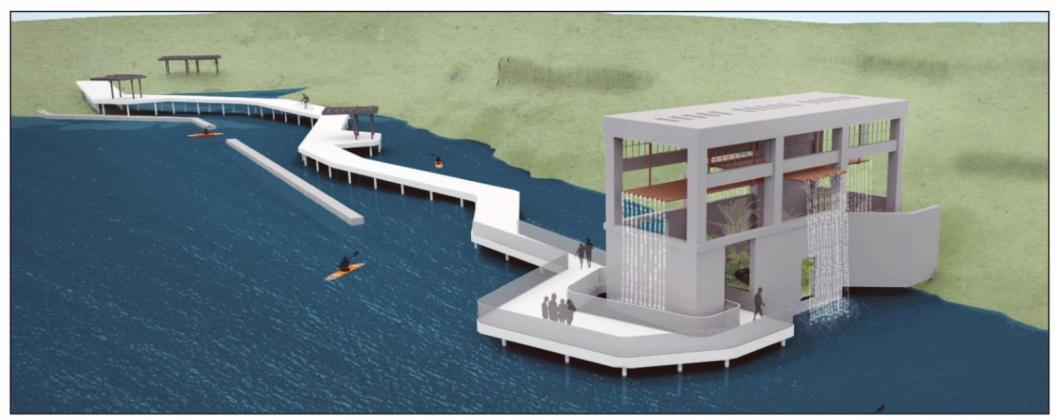

Projects include a boardwalk, manmade waterfall at the historic power house at the foot of Chili’s, bridges across Backbone Creek, extension of the EDC business park, offsite improvements for drainage and stormwater around the planned hotel conference center; parking at southend of downtown district, RV spaces below the skate park for parking lot; and some Avenue H parking on both sides.

Marble Falls EDC Financial Adviser Andrew Friedman discussed the EDC’s financial outlook to justify approval of the EDC taking on $8 million in new debt service paid for through sales tax collections.

“Very strong. EDC enjoys and A+ credit rating, one notch below the city’s,” Friedman said. “EDC can support (its debt with) sales taxes,” he said. “That’s a much more volatile source compared to your ad valorem taxing abilities.”

He added how characteristics of the bonds may be different than municipal bonds.

“There are mechanisms within a sales tax revenue bond to give the bond investor security. That means we have to generate gross sales taxes that are at least 150 percent our maximum annual debt services,” he said. “That ensures that we’re generating a lot more revenue than we need.”

Friedman explained how a “volatile” market may involve a “tapering” of interest rates as early as 2023.

“These bonds priced at an average (interest rate of) 3 percent,” he said. “That seems a little high but that’s because bond investors who are only getting a pledge of those sales tax revenues need to be compensated for that additional risk.

“We’re in a strong position there,” he added. “The EDC has very strong reserves in order to cover any unforeseen developments in the economy.”

The council voted 6-0 to accept the EDC’s plan to issue sales tax bond debt. Councilman Reed Norman was not in attendance.